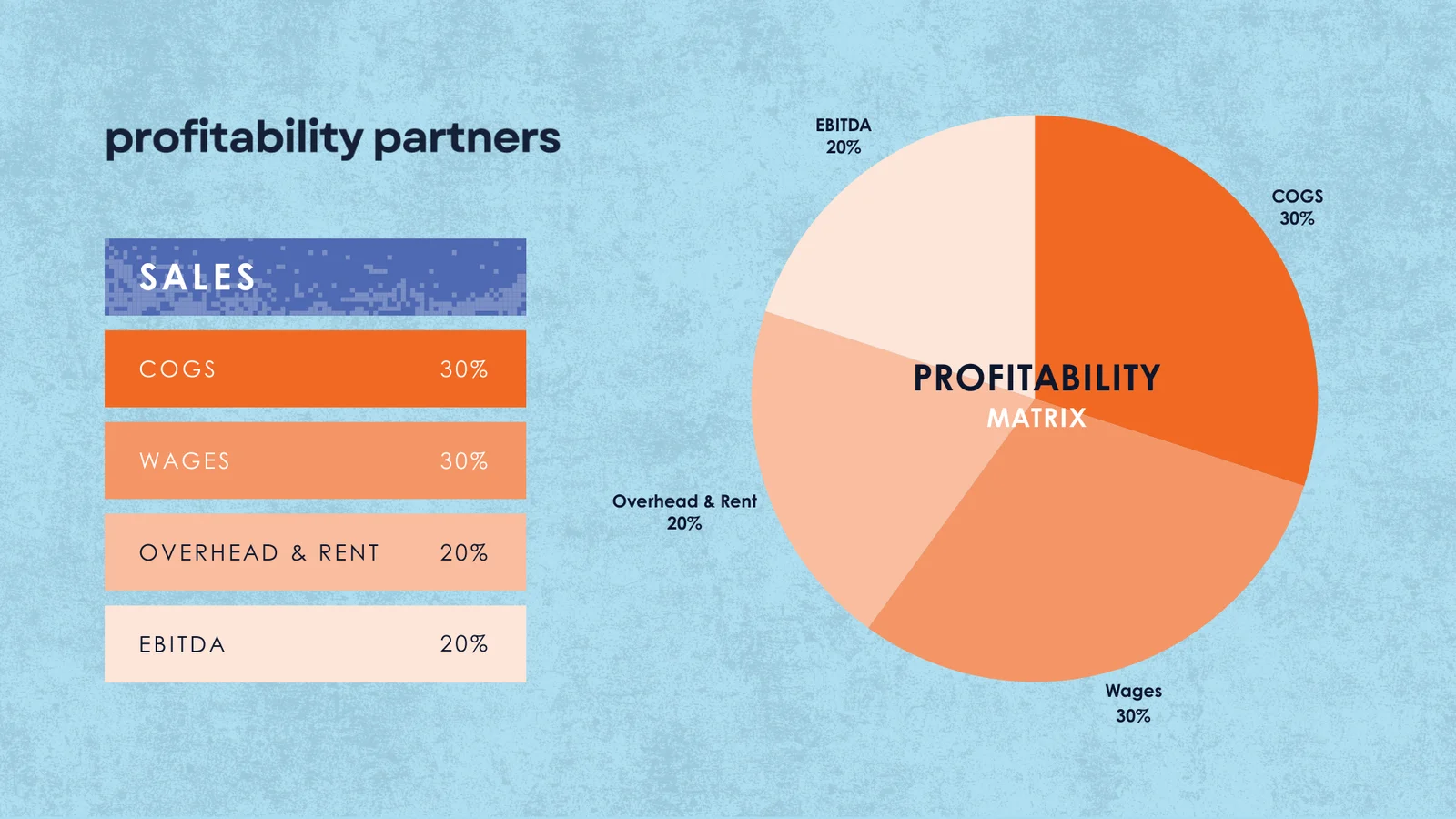

Expanding your hospitality business, whether through acquiring a new venue, launching a second location, or revamping an underperforming space, requires more than just ambition. It demands a clear understanding of how the new opportunity fits into your financial goals. This is where the Profitability Matrix becomes an invaluable tool.

By breaking down key metrics like revenue, COGS, wages, variable overheads, rent, and operating profit, the Profitability Matrix provides a detailed financial snapshot that can help you evaluate potential acquisitions or expansions. Here’s how to use it to make smarter, data-driven decisions.

1. Start With the Numbers: Revenue and Rent

When assessing a new venue, the first step is to look at sales revenue in relation to rent costs. Rent should ideally be less than 8% of sales and no more than 10%.

- Why This Matters: A venue with high rent relative to its revenue will struggle to achieve profitability, even if other costs are well-managed.

- Red Flag Example: A venue generating $30,000 in weekly revenue but paying $4,500 in rent (15%) is unlikely to be a sustainable investment.

- Opportunity Example: A venue with weekly sales of $40,000 and rent at $3,200 (8%) is more viable, leaving room to improve other areas.

Key Insight: A strong rent-to-revenue ratio sets the foundation for profitability.

2. Analyze Current Costs Against Industry Standards

Using the Profitability Matrix, compare the venue’s existing costs to industry benchmarks:

- COGS (Cost of Goods Sold): Food COGS should ideally be 28-32%, while beverage COGS should be 25-30%.

- Wages: Target wage percentages are 28-32% of revenue.

- Variable Overheads: These should fall between 12-16%.

Red Flag Example: If a venue has food COGS at 38% and wages at 40%, it indicates poor cost control and potential inefficiencies.Opportunity Example: A venue with food COGS at 30% and wages at 33% might only need slight adjustments to align with profitability goals.

Key Insight: Identifying areas where costs exceed benchmarks helps you determine if the venue’s challenges are fixable.

3. Look for Revenue Growth Potential

Profitability isn’t just about managing costs, it’s also about maximizing revenue. Consider the venue’s potential to increase sales through:

- Untapped Spaces: Function rooms, beer gardens, or rooftops can become high-revenue areas with minimal investment.

- Event Opportunities: Does the venue have the layout or location to host live music, trivia nights, or other high-margin events?

- Product Mix Improvements: Could better menu engineering or upselling strategies boost the average spend per customer?

Example: A venue with a largely unused upstairs space capable of holding 100 people represents significant upside if marketed as a function area.

Key Insight: Growth potential is just as important as current performance.

4. Evaluate the Market and Location

Understanding the venue’s location is crucial for predicting future performance.

- Local Demographics: Does the venue cater to the right audience? For example, a fine dining restaurant in a casual suburban area might struggle.

- Competition: Assess nearby venues. Is the market saturated, or is there room to stand out?

- Foot Traffic: High foot traffic areas often provide more consistent revenue streams.

Key Tip: Even the best-run venue can struggle if it’s in the wrong market or location.

5. A Real-Life Example: Turning Losses Into Potential

I recently worked with a client who was considering acquiring two pubs. Both pubs had reasonable revenue levels, and rent accounted for around 9% of revenue, which was acceptable. However, both pubs were running at significant losses due to high overheads, wages, and COGS.

Using the Profitability Matrix, we highlighted these inefficiencies and compared them to the client’s existing venues. The analysis showed that while the pubs were currently unprofitable, they had strong potential for improvement if costs could be brought in line with industry benchmarks.

What gave the client confidence to proceed was his adoption of the PERI framework (Plan, Execute, Results, Improve) across all his venues. With a proven process for measurable improvement, he could see a clear path to reducing costs, increasing revenue, and turning the pubs into profitable assets. Confident in this approach, the client made an offer, recognizing that the inefficiencies were not due to market conditions but poor operations.

Key Insight: The Profitability Matrix and PERI framework work hand-in-hand to identify opportunities and implement improvements.

6. Plan for Improvements Post-Acquisition

The Profitability Matrix doesn’t just help you evaluate a new opportunity, it guides your improvement strategy after the acquisition.

- Set Benchmarks: Establish clear goals for COGS, wages, and other costs based on industry standards.

- Forecast Revenue Growth: Create realistic projections for how sales could increase with targeted efforts.

- Monitor Progress: Use the matrix to track improvements weekly, monthly, and yearly, ensuring the venue moves toward profitability.

Key Tip: A structured improvement plan ensures that your investment delivers the desired returns.

Make Informed Decisions With the Profitability Matrix

Expanding your hospitality business requires more than intuition, it demands careful analysis and planning. The Profitability Matrix simplifies complex financial data, allowing you to assess new opportunities with clarity and confidence.

By evaluating revenue potential, cost structures, market conditions, and operational challenges, you can make informed decisions that align with your financial goals. When paired with the PERI framework, you have the tools to not only identify opportunities but also execute a clear plan to improve operations and profitability.

Whether you’re acquiring a new venue or expanding an existing one, the Profitability Matrix ensures you’re investing in opportunities that will drive long-term success.